Enhancing payout through flexibility & transparency

2021

Mobile application

Gobiz is an app that is designed to be used by Gojek's merchants in receiving orders, managing outlets and seeing transaction history. Previously, there is a feature called payout that facilitated merchants in tracking their automatic earnings transfers to their actual bank accounts. However, the feature lacked in flexibility and transparency over merchant's earnings. Therefore, this project was aimed to improve its flexibility of when to do payout and transparency about their earnings.

Who are the users?

Gobiz caters to Gojek's diverse range of merchants, spanning from small businesses to large corporations. Their age demographic varies from 20s to above 45, with varying levels of tech savviness.

What is my role?

As the product designer, I took full ownership of the project & led the entire design process, from gathering requirements to designing the final user interface. I collaborated with a UX writer & illustrator to refine the final content and assets, as well as researcher in conducting validation.

What are the goals?

The project aimed to enhance our merchants' payout experience by offering greater control over payouts & increased transparency of their earnings.

What we are solving?

The current limitation of merchants on the flexibility to do payout and being able to clearly understand their earning mechanism

Setting up

Requirements

Problem statement

Following the payout feature release, our merchant care unit received an average of 1,407 monthly complaints over the past year, with 92% of it relating to its lack of flexibility and transparency.

High level solution

Jobs to be done

As merchants.

I want to be able to see the current available earnings.

So that i know how much is available for withdrawal.

As merchants.

I want to view detailed activities or transactions that contribute to my total earnings.

So that I can understand the calculation process and enable me to reconcile my earnings independently.

As merchants.

I want to be able to initiate payouts whenever I choose.

So that i can manage the money according to my needs.

As merchants.

I want to be able to understand of new payout-related terms or glossary.

So that i can understand the the entire process accurately.

Measuring

our success

Reduce the number of payout-related complaints

Minimizing merchant care unit's request tickets handling & negative reviews on Playstore.

Reduce payout frequency for each merchant

It will help us enhancing our processing time & operational efficiency.

Improve merchant satisfaction

Allowing us to increase our MSAT score in feature completeness & reliability survey.

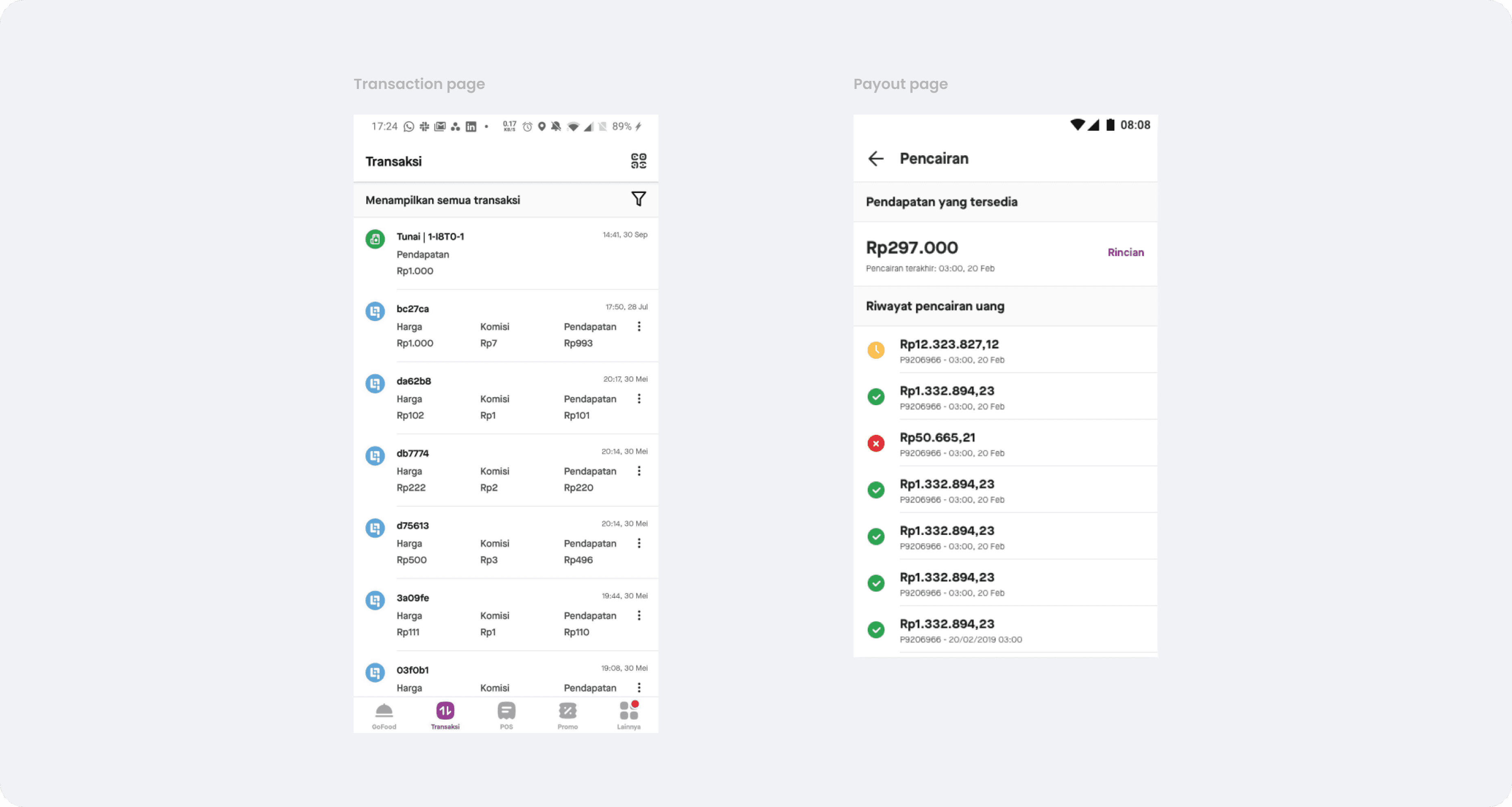

The current condition

In the Gobiz app, there are currently two separate features that essentially serve the same function as our initial idea of wallet. This features are the transaction page for viewing transaction history and a payout page for monitoring ongoing & past payout processes.

Pain points identified in the current features

The current automated payout system lacks flexibility, preventing merchants from initiating payouts according to their preferences.

The transaction history is not directly linked to the available payout balance shown on the payout page.

The total payout balance represents an accumulation of earnings from previous days up to the cutoff time. Therefore, it's not updated in real-time and may not reflect current earnings.

All the amounts displayed in the payout page represent net revenue after deductions, but merchants lack visibility into the breakdown of those.

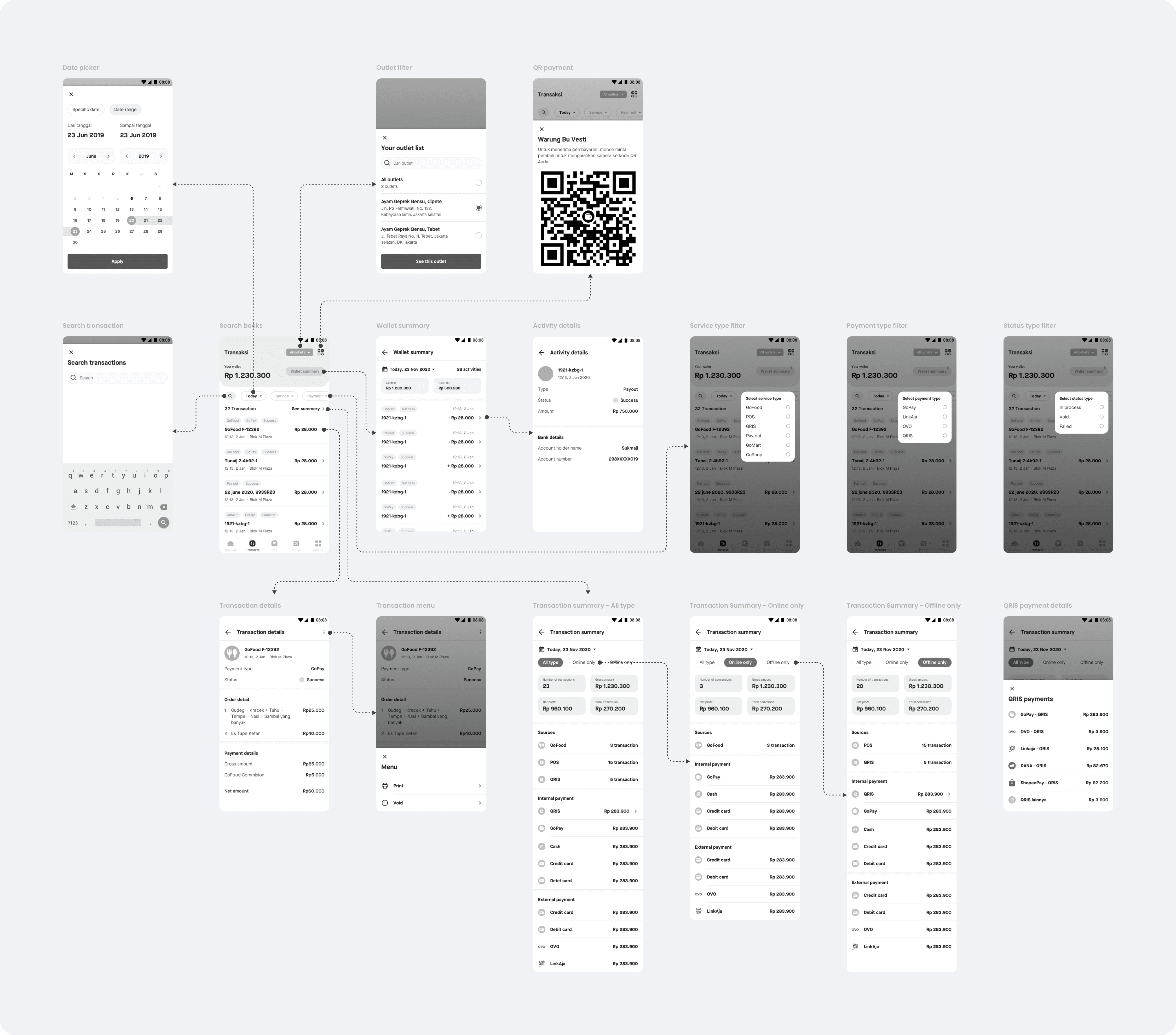

Idea exploration

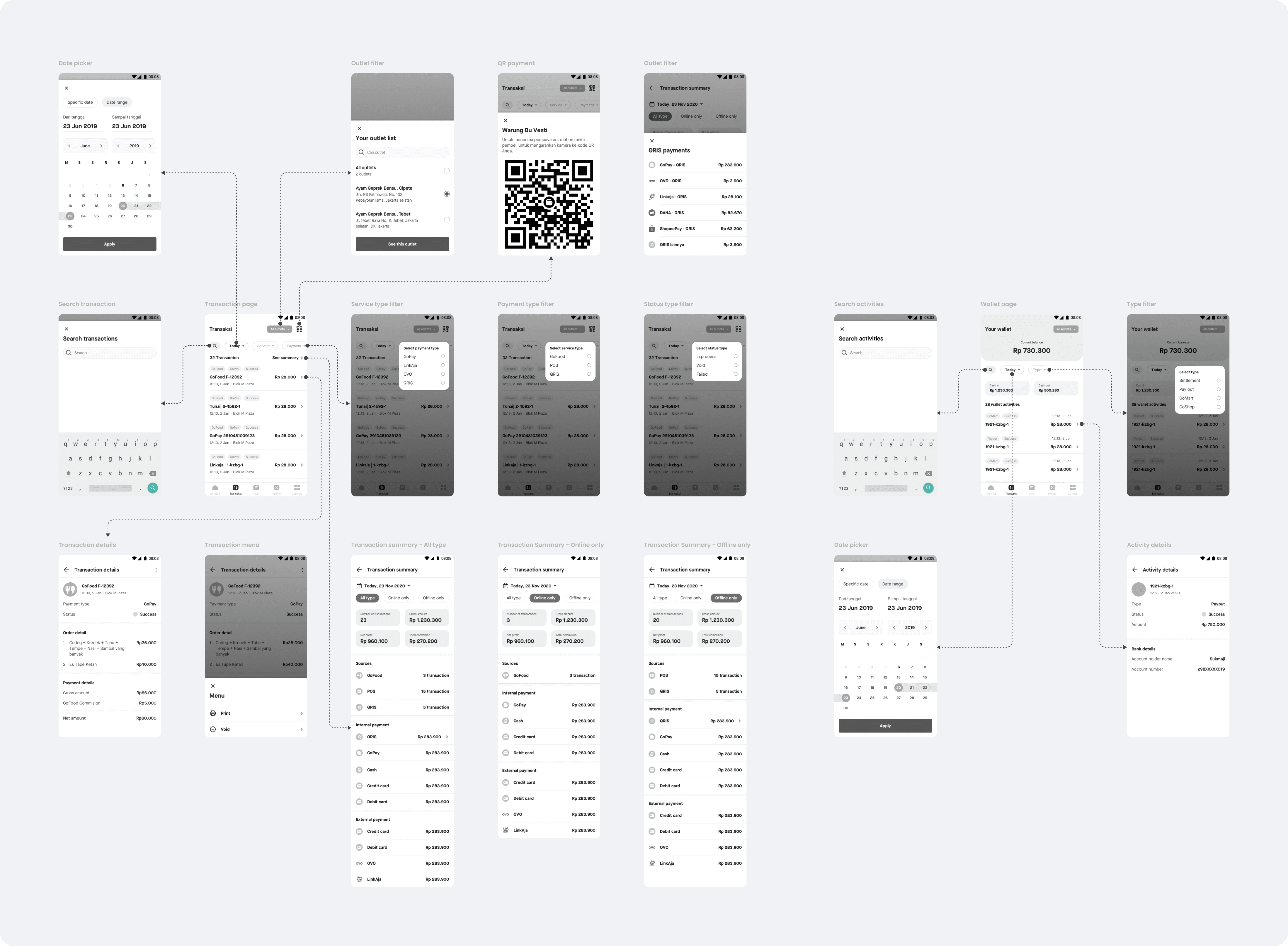

Initially, based on our brainstorming, we planned to merge the existing transaction page and payout page features which will be introduced as wallet later. As a result, two wireframe variations were created to explore which ideas best meet our user's needs.

Merging transaction page & payout page features

In this variation, I attempted to merge the two features into a single page. The goal is to provide users with a unified place to view their transaction history and payout balance, which now will be introduced as wallet balance. Two separate summaries are added: one for wallet activities and another for transactions, as not all transactions affect the overall wallet balance.

Keeping the transaction page and payout page separate

In this variation, the transaction page and payout page are entirely separate. The current payout page will evolve into the new wallet page, containing wallet balance, wallet activity history, and on-demand payout capabilities. Meanwhile, the transaction page will retain its function as the place for viewing transactions or orders recorded through the GoBiz app, regardless of payment type.

Final wireframe

After extensive discussions with multiple stakeholders and the team, we have decided to separate transaction and payout feature, focusing solely on enhancing the payout feature for this initial iteration, by introducing it as wallet. This decision is rooted in the drawbacks and limitations we identified, including:

The transaction page will be accessible only to selected merchants based on their opted-in products and location.

As not all types of transactions contribute to the overall payout balance, it's crucial to avoid misinterpretation by clearly distinguishing them

Combining these features would require the efforts of two separate teams, potentially stretching their bandwidth even further.

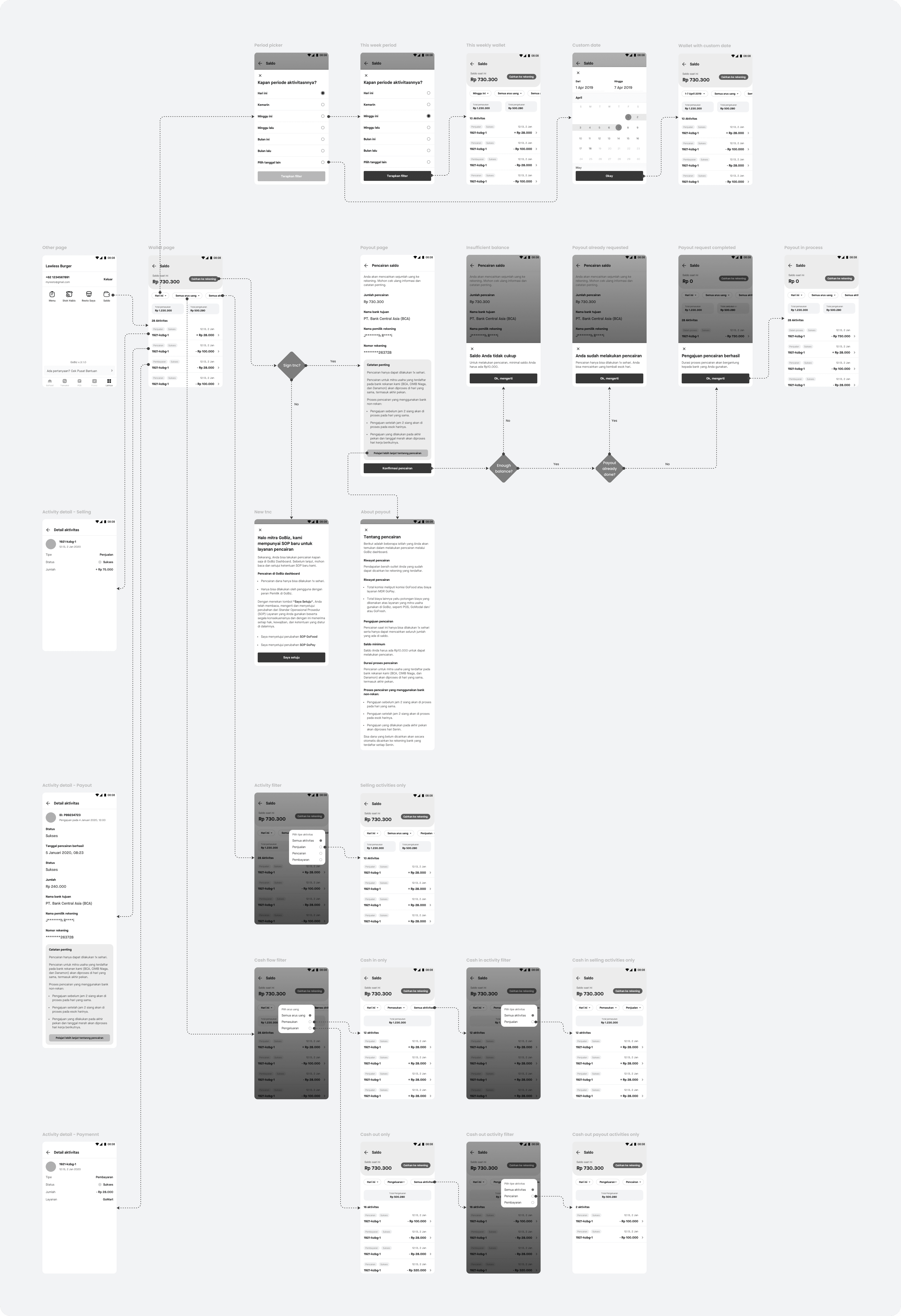

Validating

our hypothesis

To ensure the proposed idea of the final wireframe effectively addresses the initial problem and can provides a better experience, it's crucial to gather true user feedback at this stage. To accomplish this, I involved our researcher to plan and conduct usability testing with our actual users. Below are the feedbacks we gathered:

The new concept of wallet page

Since we've decided to retain the same technical implementation for previous payout-able earnings, users may not immediately grasp this from the UI. They tend to assume that the list of activities corresponds directly to the wallet balance displayed on the top.

Consequently, users also expect that as they adjust the filter (by date, type, or view), the wallet balance will change accordingly.

Wallet activity list, filter & details

Users are primarily aware of the date filter and expect to be able to display activities based on their type.

Users tend to focus more on transaction types like GoFood, GoPay, POS, etc., to aid them in reconciliation, rather than on transaction IDs, as highlighted in the wireframe. At the same time, the activity types (payment, sales, or payout) are too small, making it difficult for users to differentiate them.

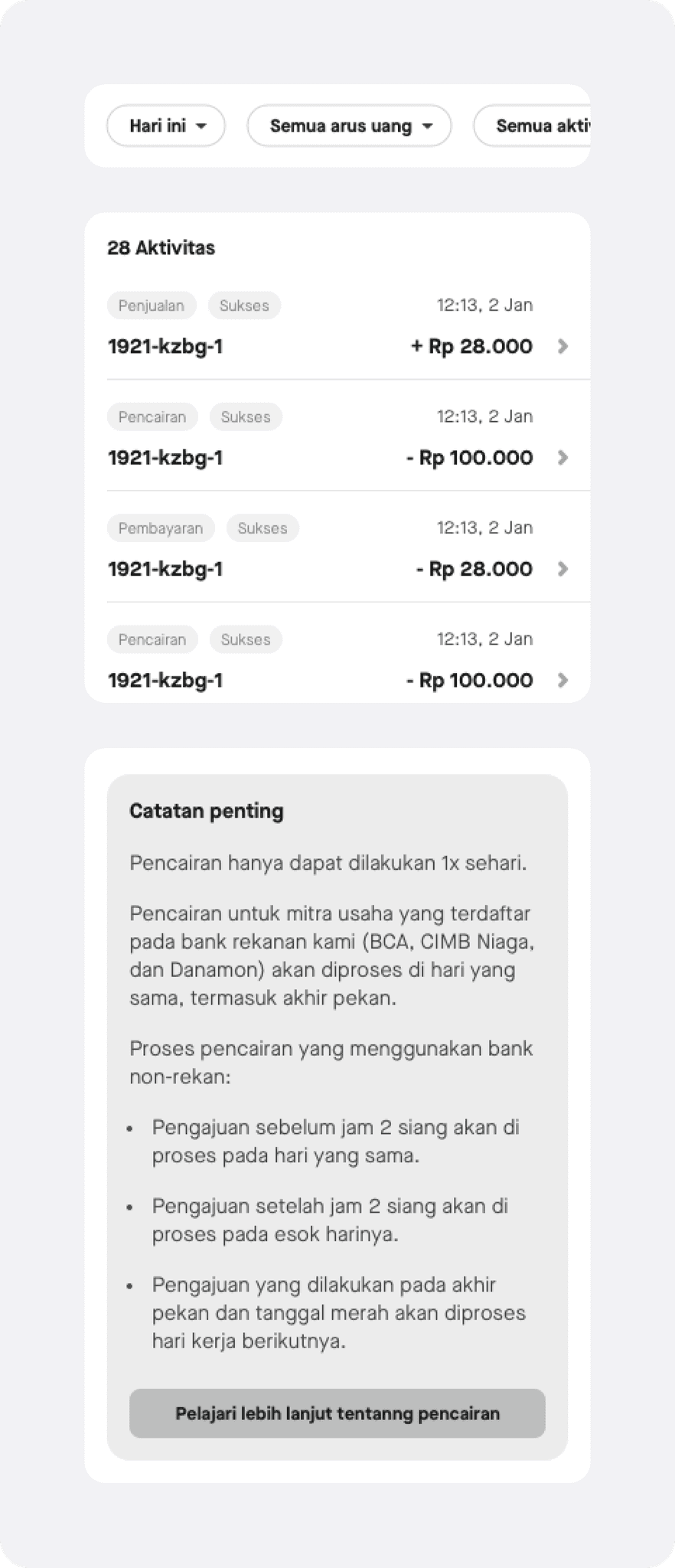

In the activity details for payouts, users feel that the "important notes" are more significant compared to the bank details since it always remains constant.

On demand payout process

The overall flow appears too streamlined, requiring only two steps, which may cause users to overlook that they have requested a payout, considering it an important action.

The "Important notes" section feels more crucial to provide users with context and understanding of the process compared to the details of the amount and bank, as these remain the same each time.

Final UI design

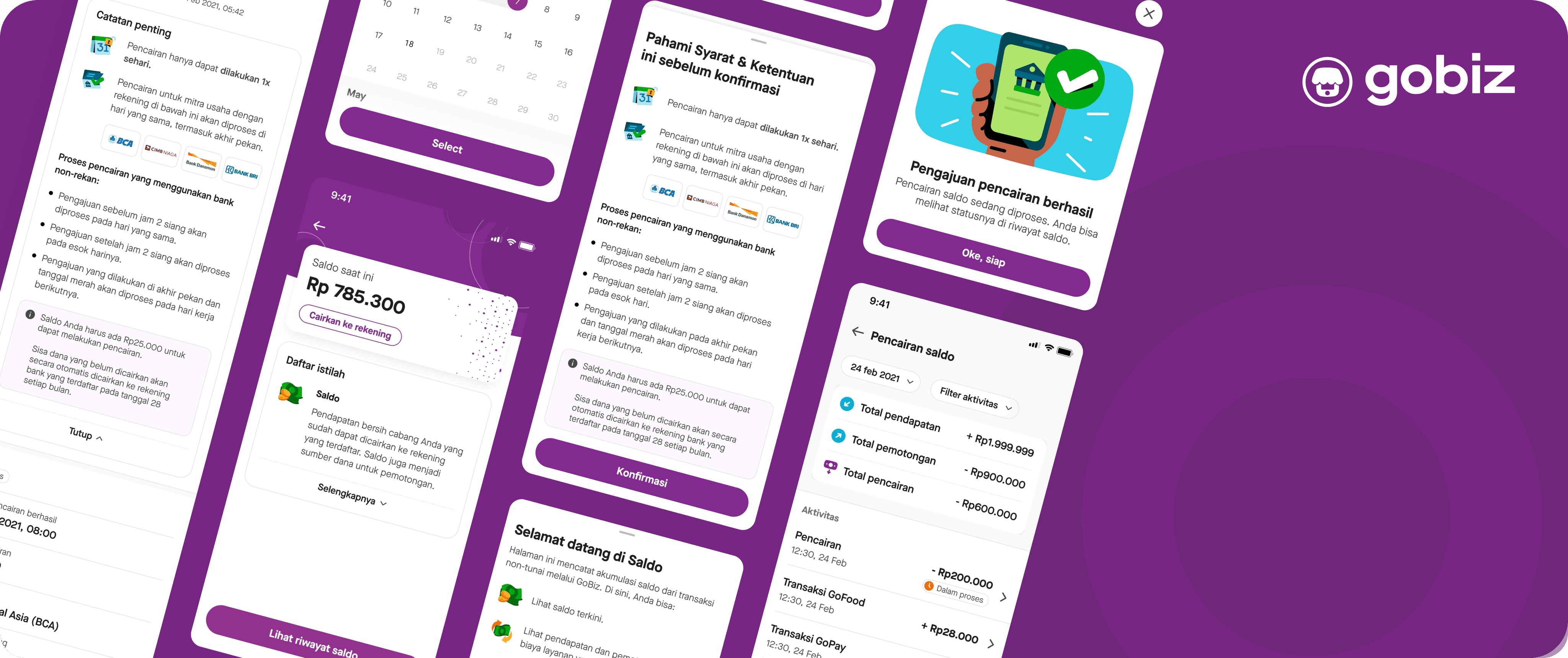

After multiple iterations and extensive back-and-forth feedback gathering with the stakeholders and teams involved. Finally, I've arrived at the final UI designs for the payout feature improvements.

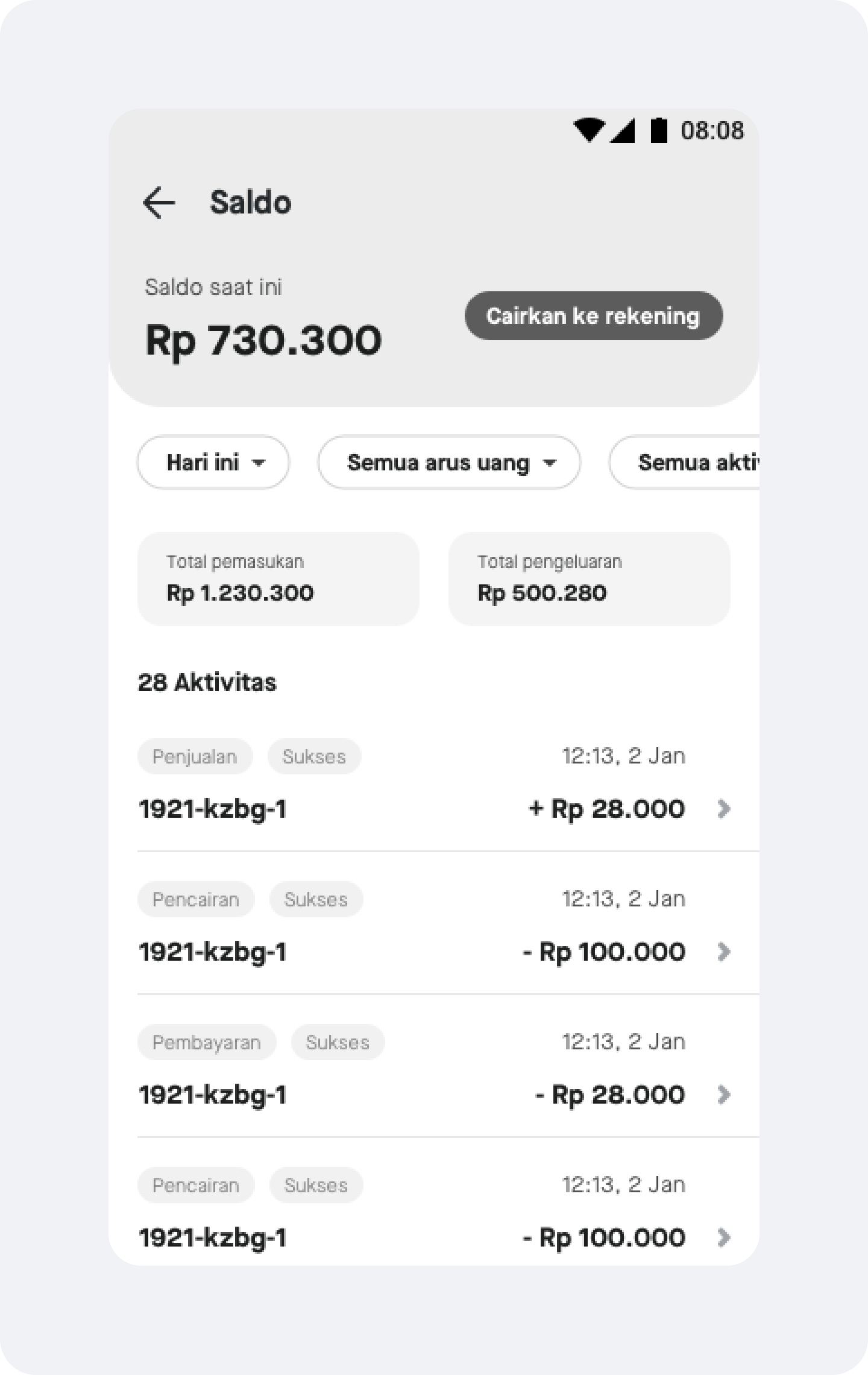

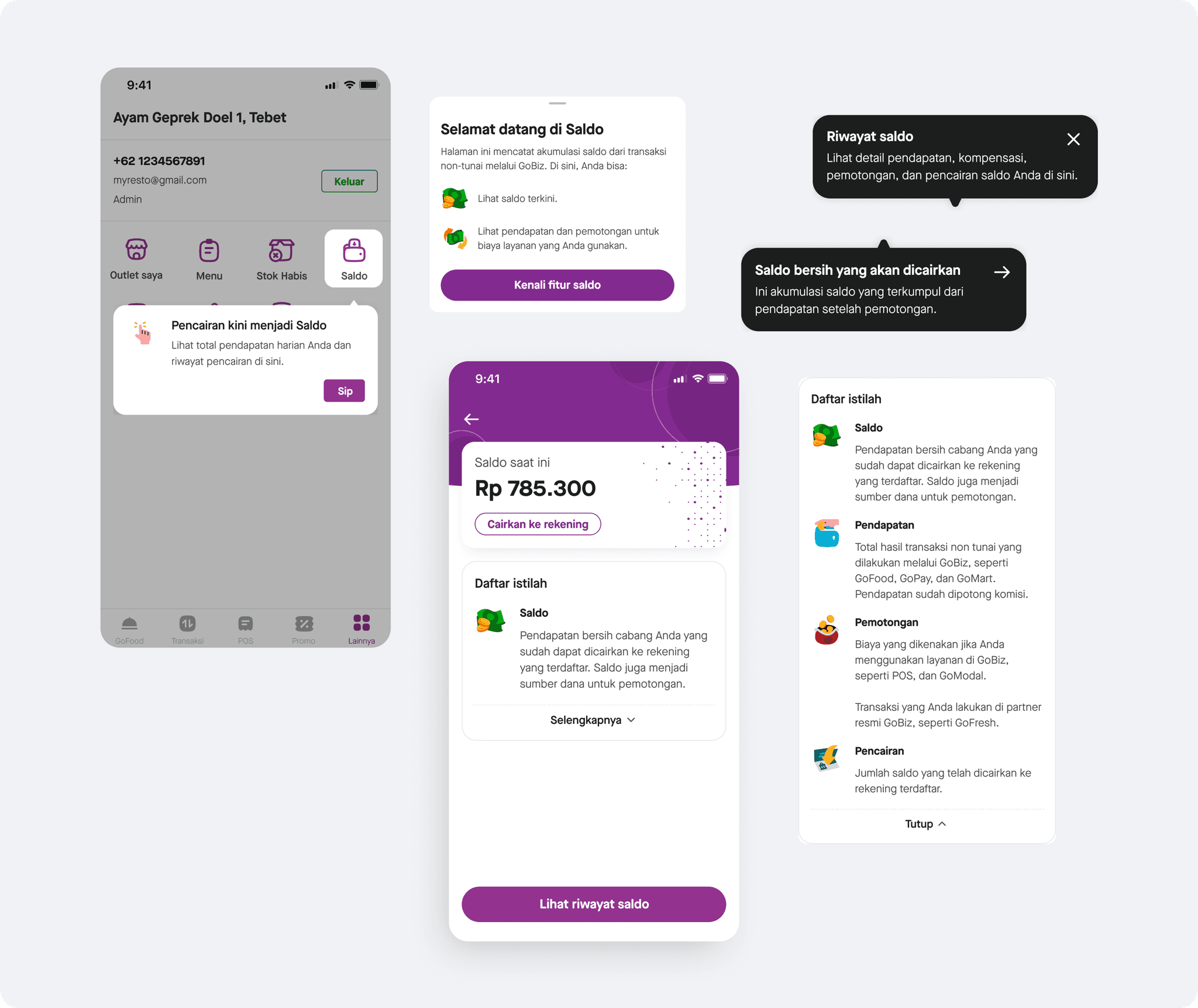

The new wallet feature

Based on the results of our usability testing, it's essential to ensure that merchants can understand the new concept of the wallet. To achieve this, I have completely separated the current balance and activities history into two different pages. This separation will help merchants avoid associating them together, reducing cognitive load and facilitating a clearer understanding of the entire concept.

Furthermore, the remaining space on the page can be utilized to provide a better understanding of new terms that may not be familiar to users. By combining this with additional learning opportunities such as coach marks and one-time feature introductions, I can enhance their comprehension and overall satisfaction with the wallet feature. This comprehensive approach ensures that users are equipped with the necessary knowledge to effectively navigate and utilize the wallet feature.

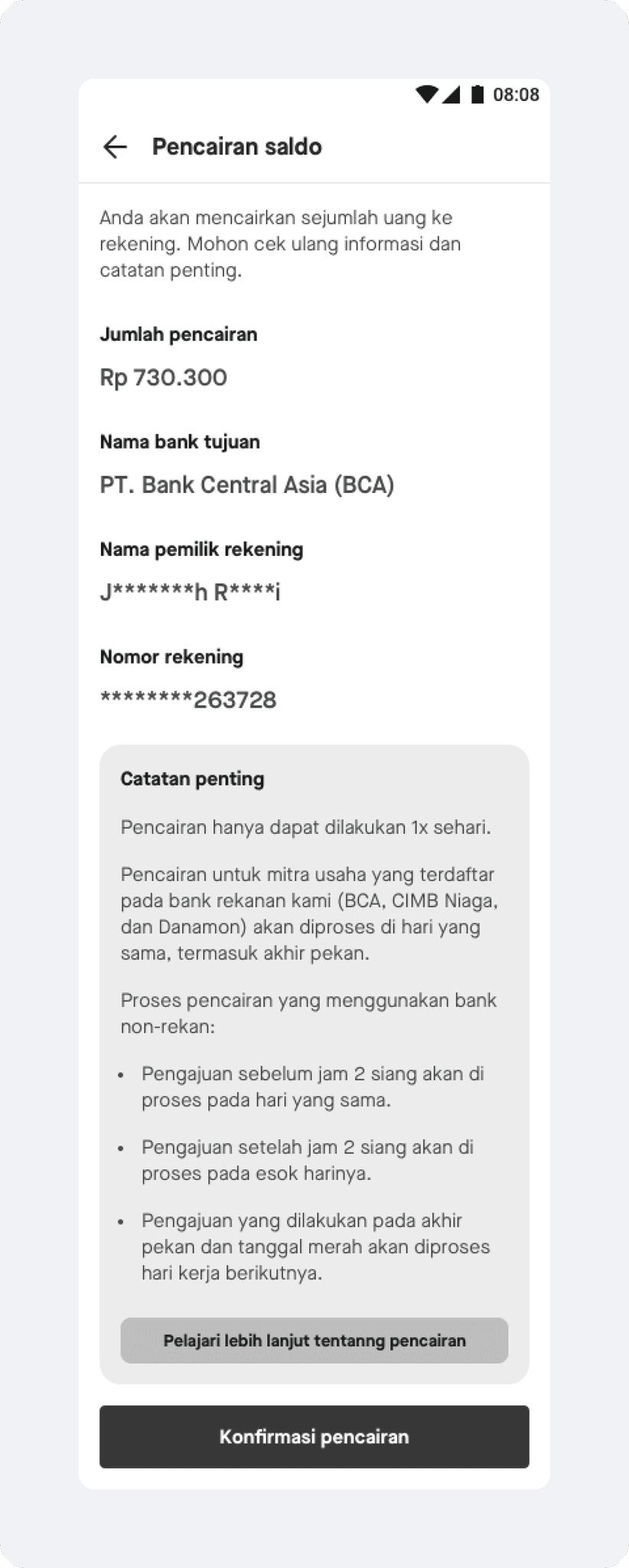

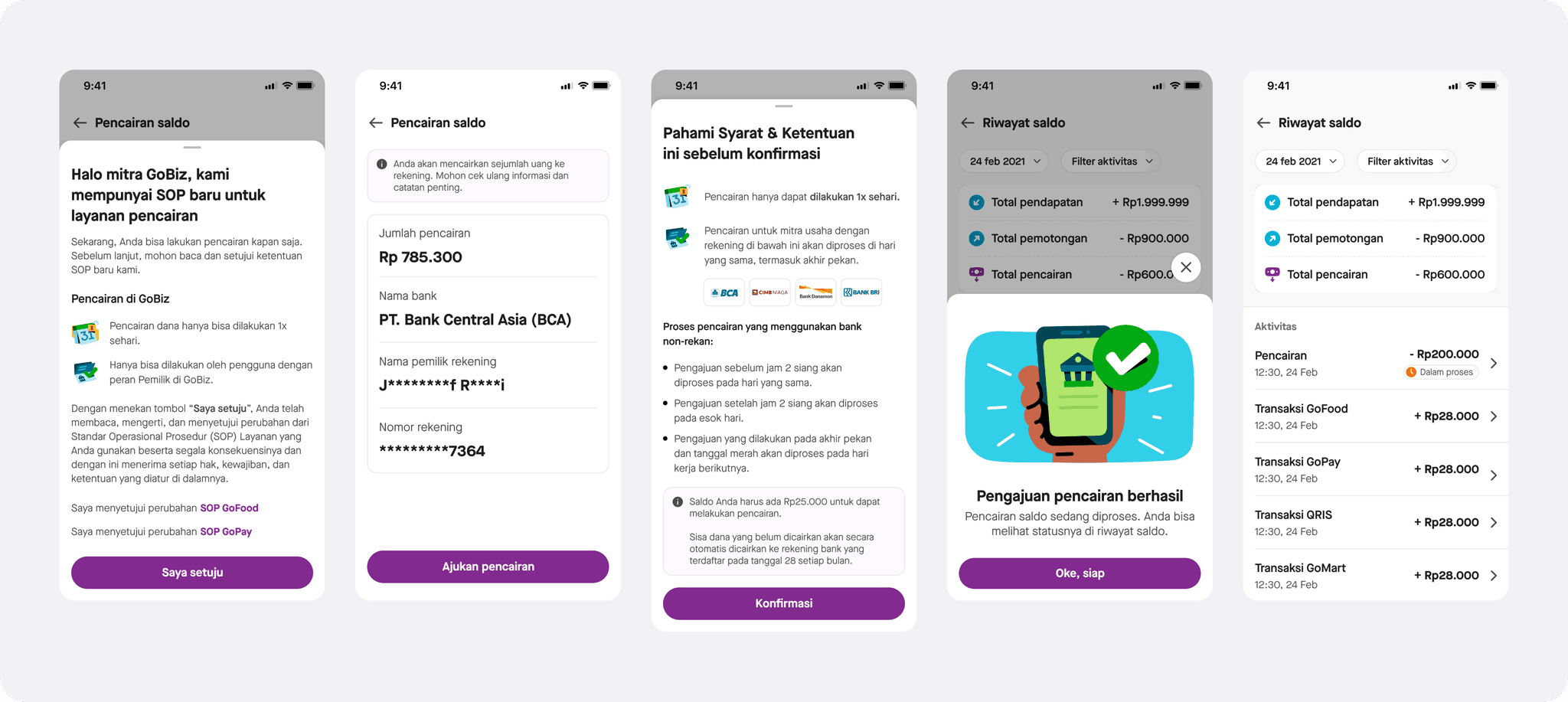

Requesting a payout from the wallet balance

In response to initial user feedback suggesting that the payout request flow seemed too streamlined for such an important action, another drawer have been added that appears upon confirming the payout. This additional drawer also serves as a reminder about our payout process mechanism and conditions.

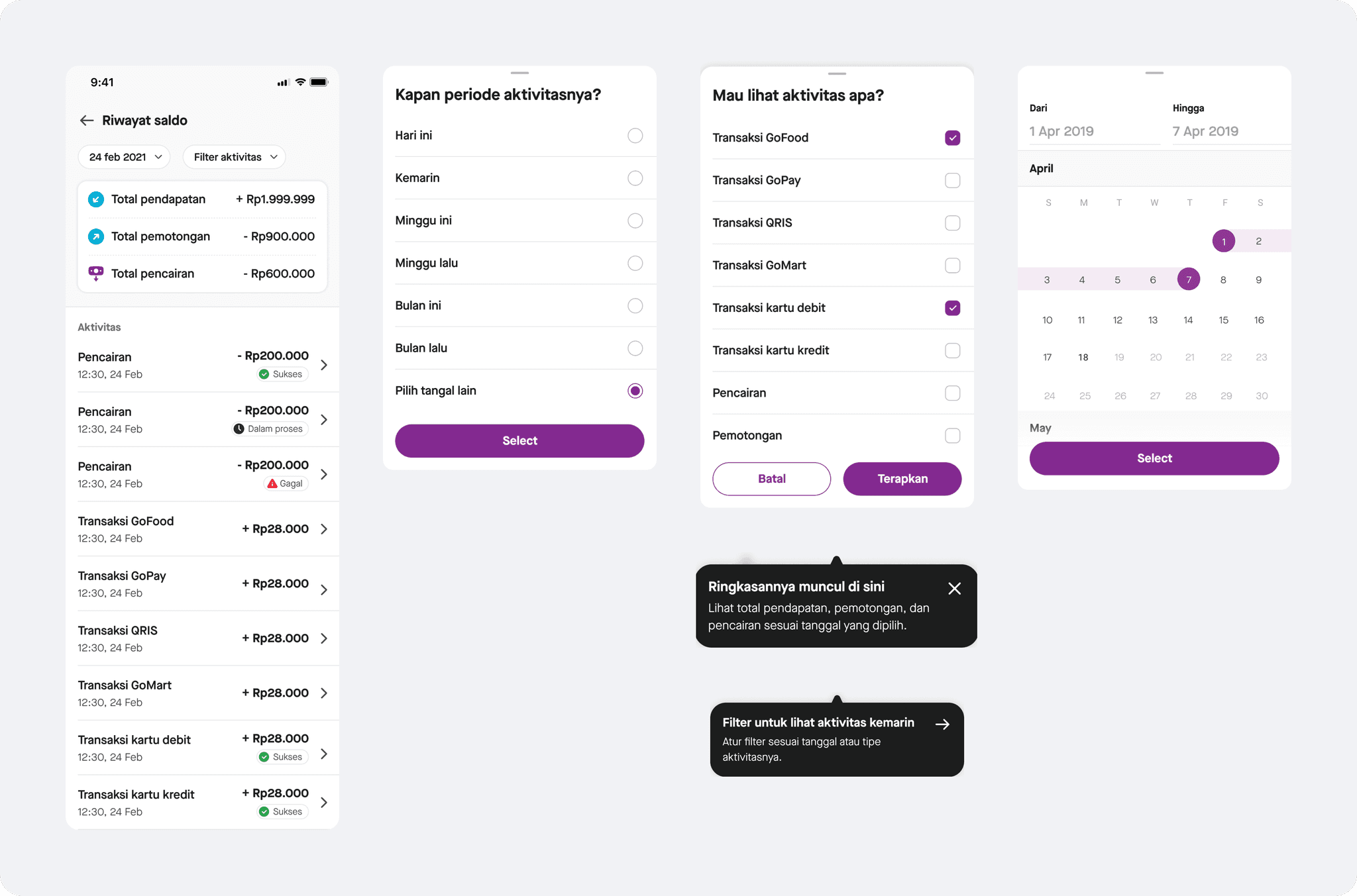

Wallet activity history

As the activity history is now separated from the main page, further summaries are provided in terms of three cash flow types: income, deduction, or payout. Now, the activity type serves as the primary identifier for the activity list, and the transaction ID has been completely removed, as it is not essential for merchants' needs. However, it remains accessible from the activity details page.

Additionally, the filters of 'cash in' or 'cash out' have been removed, as they represent broad groups of activity types that users may not find necessary and could potentially cause confusion. In compensation, users can now select multiple activity types through the activity type filter.

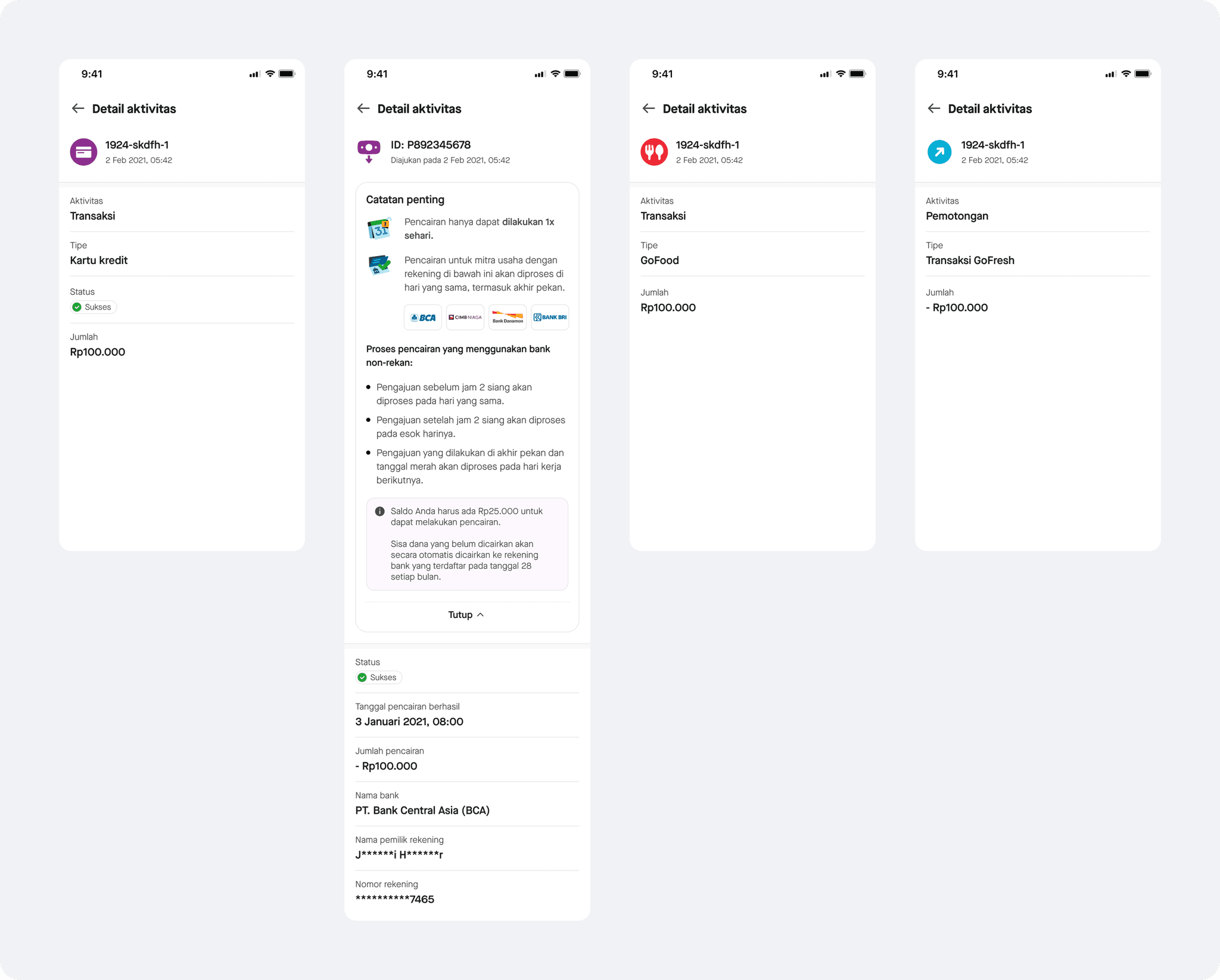

Viewing the details of wallet activities

To ensure clarity, the details page will only include essential information tailored to each activity type. Specifically for payout details, the 'important notes' are added to enhance user understanding on the payout mechanism.

Impact delivered

After 3 months since the feature release, the number of monthly complaint tickets related to payouts or wallets has decreased by 75.67%, resulting in only average of 342 tickets received by our merchant care unit monthly. at the same time, the payout frequency has also been reduced to an average of 12 times per month, compared to previously where is occurred daily.