Enhancing payout through flexibility & transparency

2021

Mobile application

Gobiz is an app that is designed to be used by Gojek's merchants to manage orders, outlets, and transactions. Previously, the Payout feature allowed automatic transfers of earnings to bank accounts but it lacked flexibility and transparency. This project focused on redesigning the experience to give merchants greater control over when they receive payouts and clearer visibility into their earnings, empowering them to manage their finances with confidence.

Who are the users?

A diverse range of Gojek merchants, from small businesses to large enterprises. Users range from their 20s to 45+, with varying levels of tech-savviness.

What is my role?

As the product designer, I owned & led the end-to-end design process, from gathering requirements to delivering the final UI. I collaborated closely with a UX writer and illustrator to refine content and visuals, and partnered with a researcher to validate the solution with real users.

What are the goals?

The project aimed to enhance the payout experience by giving merchants more control over when they get paid and greater transparency into their earnings.

What we are solving?

Limited flexibility in when to do payouts and a lack of clarity around how earnings are calculated and transferred.

Setting up

Requirements

Problem statement

Following the payout feature release, the Merchant Care Unit received an average of 1,407 complaints related to payout per month over the past year where 92% of which were tied to issues with flexibility and transparency.

High level solution

Jobs to be done

As merchants.

I want to be able to see the current available earnings.

So that i know how much is available for withdrawal.

As merchants.

I want to view detailed activities or transactions that contribute to my total earnings.

So that I can understand the calculation process and enable me to reconcile my earnings independently.

As merchants.

I want to be able to initiate payouts whenever I choose.

So that i can manage the money according to my needs.

As merchants.

I want to be able to understand of new payout-related terms or glossary.

So that i can understand the the entire process accurately.

Measuring

our success

Reduce the number of payout-related complaints

Minimizing merchant care unit's request tickets handling & negative reviews on Playstore.

Reduce payout frequency for each merchant

It will help us enhancing our processing time & operational efficiency.

Improve merchant satisfaction

Allowing us to increase our MSAT score in feature completeness & reliability survey.

The current condition

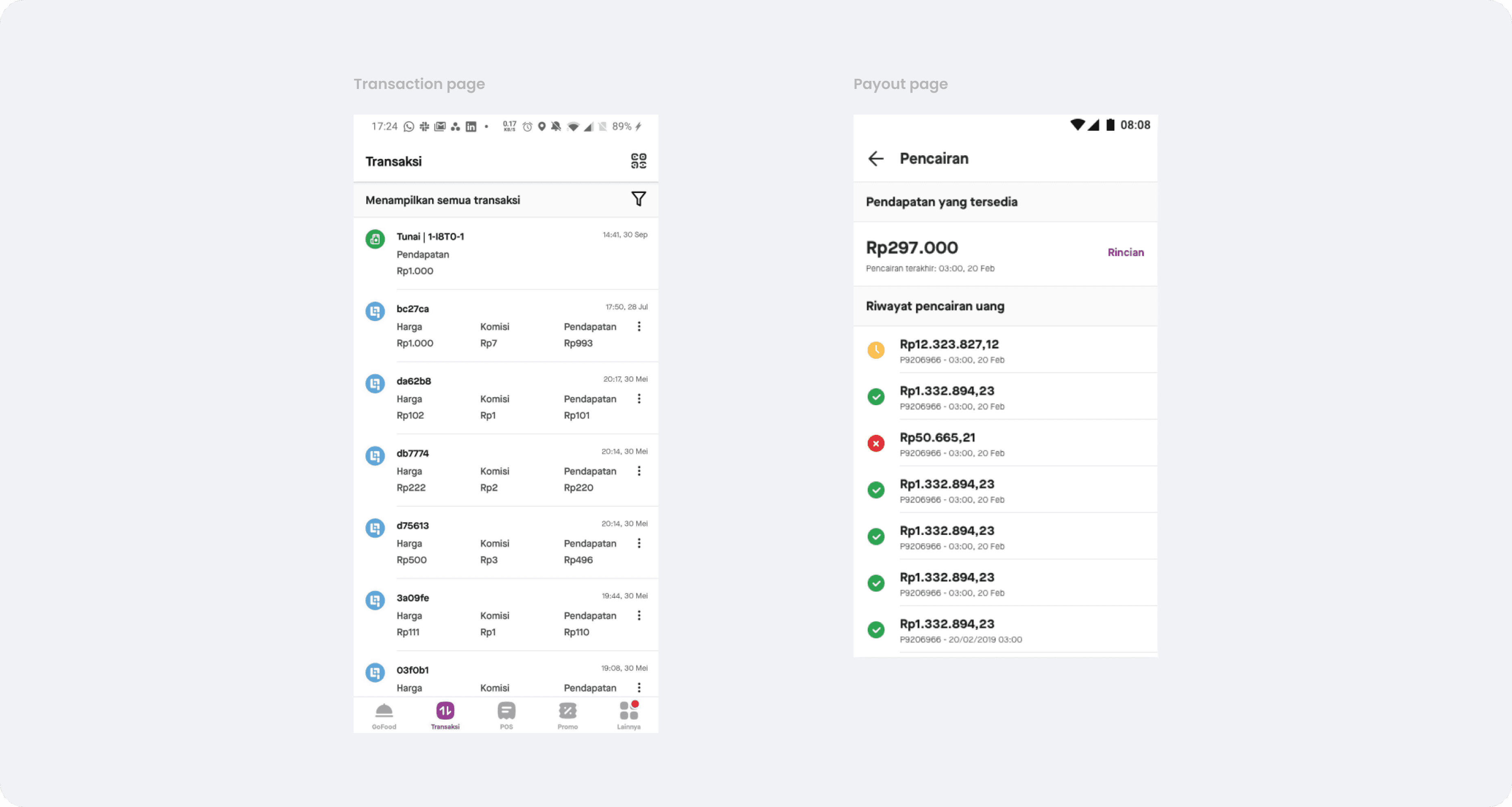

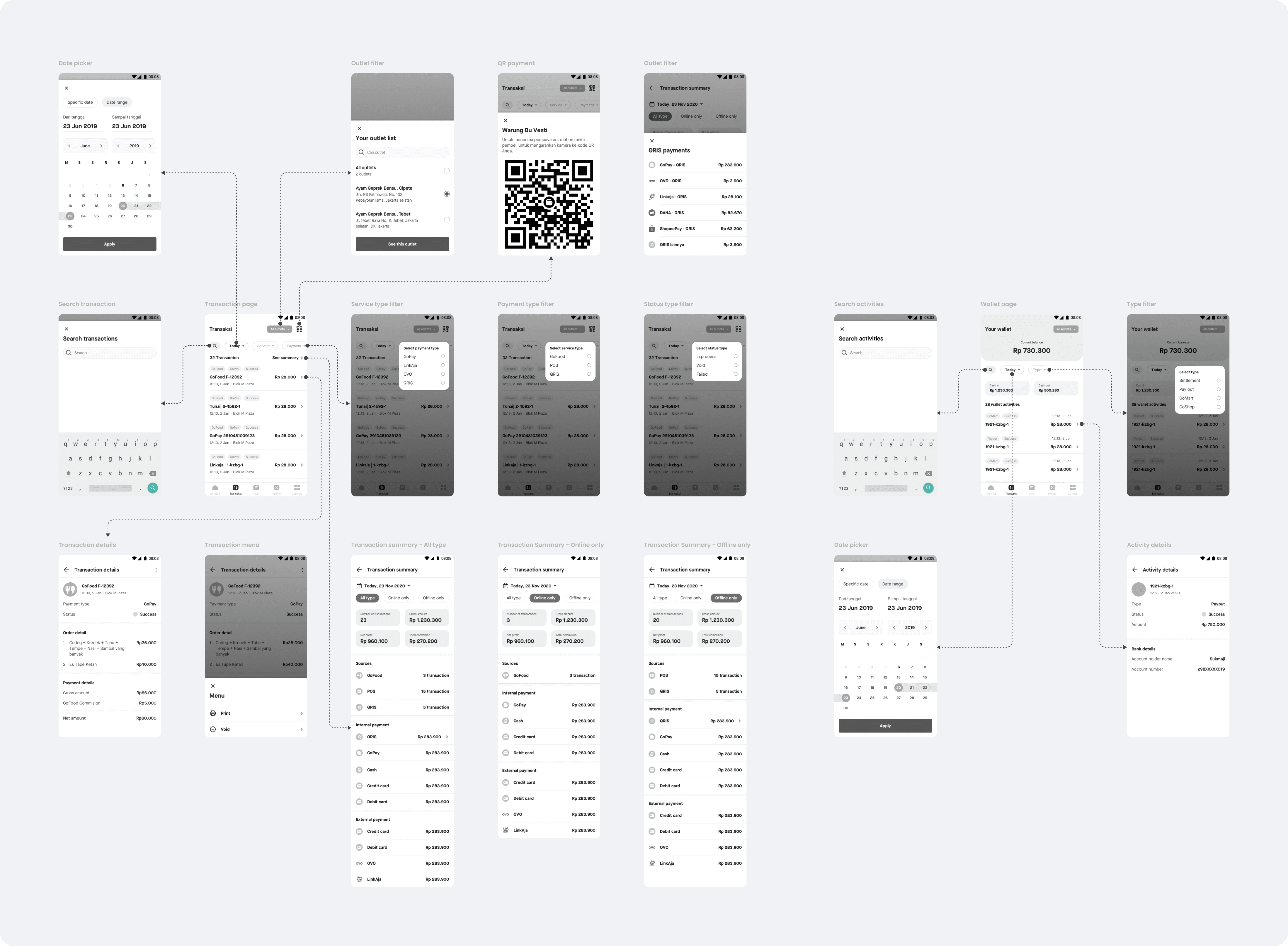

In the GoBiz app, there are currently two separate features that essentially serve the same purpose as our initial wallet concept: the Transaction page, which displays transaction history, and the Payout page, which tracks ongoing and past payout processes.

Pain points identified in the current features

The current automated payout system lacks flexibility, preventing merchants from initiating payouts according to their preferences.

The transaction history is not directly linked to the available payout balance shown on the payout page. making it hard for merchants to track where their money is coming from.

The total payout balance is calculated based on earnings up to a daily cutoff time. Therefore, it’s not updated in real-time and may not reflect the most recent transactions.

All amounts shown on the payout page represent net revenue after deductions; however, merchants have limited visibility into the detailed breakdown of those deductions.

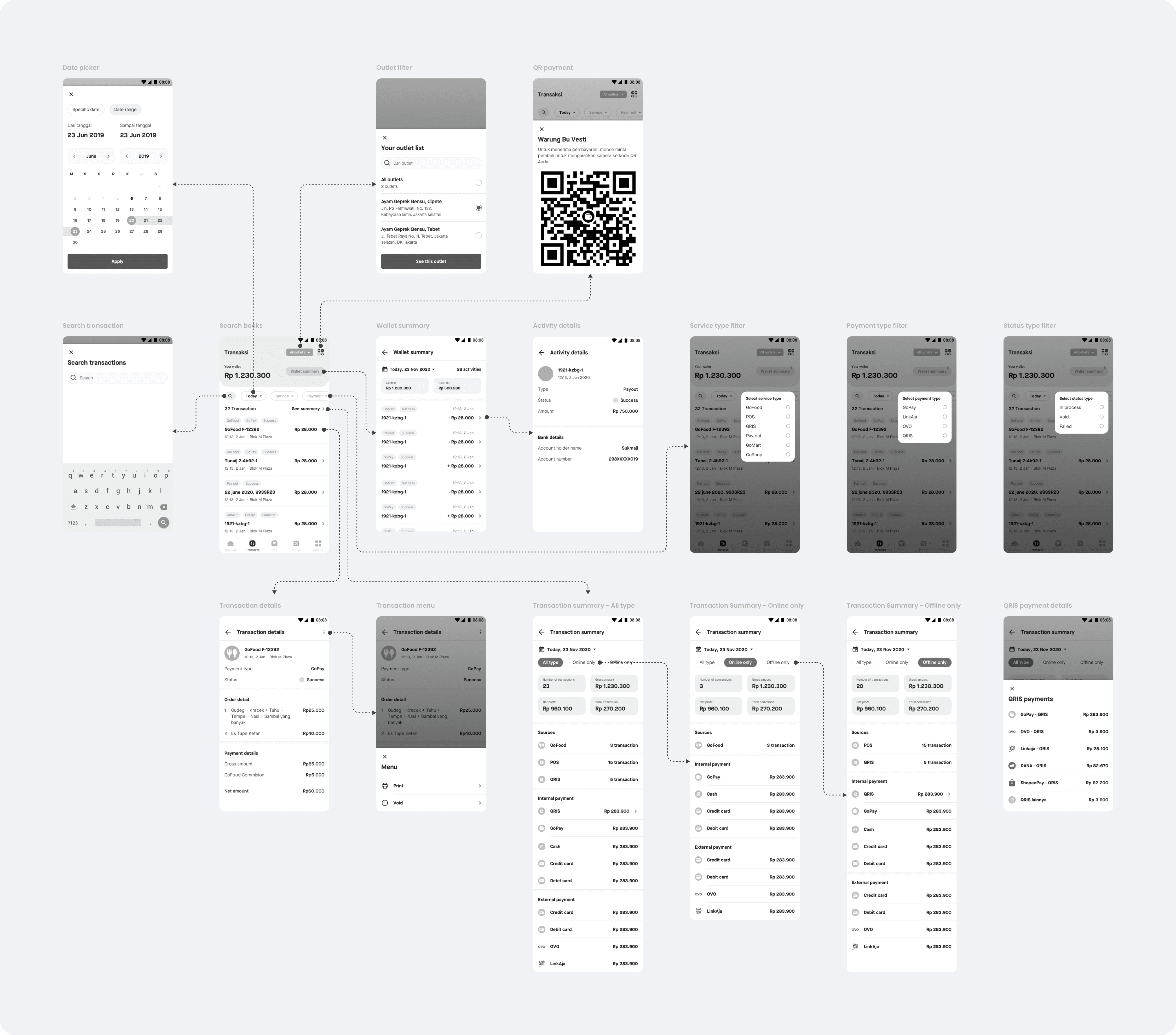

Idea exploration

Initially, through brainstorming, we planned to merge the existing Transaction and Payout pages into a unified feature which later introduced as wallet. To explore the best approach for meeting user needs, we developed two wireframe variations for comparison.

Merging transaction page & payout page features

In this variation, I merged the two features into a single page to give users a unified view of their transaction history and payout, now referred to as Wallet balance. To reduce confusion, I included two separate summaries: one for wallet activities and another for transactions, since not all transactions directly impact the wallet balance.

Keeping the transaction page and payout page separate

In this variation, the Transaction and Payout pages remain entirely separate. The existing Payout page evolves into the new Wallet page, featuring wallet balance, activity history, and on-demand payout capabilities. Meanwhile, the Transaction page continues to serve as a record of all orders processed through the GoBiz app, regardless of payment method.

Final wireframe

After extensive discussions with stakeholders and the team, we decided to keep the Transaction and Payout features separate. For this initial iteration, we focused solely on enhancing the Payout feature, reintroducing it as Wallet. This decision was based on several identified limitations:

The Transaction page is only available to selected merchants, depending on their product type and location.

Not all transactions contribute to the payout balance, so keeping them separate helps prevent misinterpretation.

Merging the two features would require collaboration between two different teams, potentially overextending their capacity.

Validating

our hypothesis

To ensure the proposed wireframe effectively addresses the initial problems and delivers a better user experience, it was essential to gather real user feedback. I collaborated with our researcher to plan and conduct usability testing with actual merchants. Below are some of the key insights we gathered:

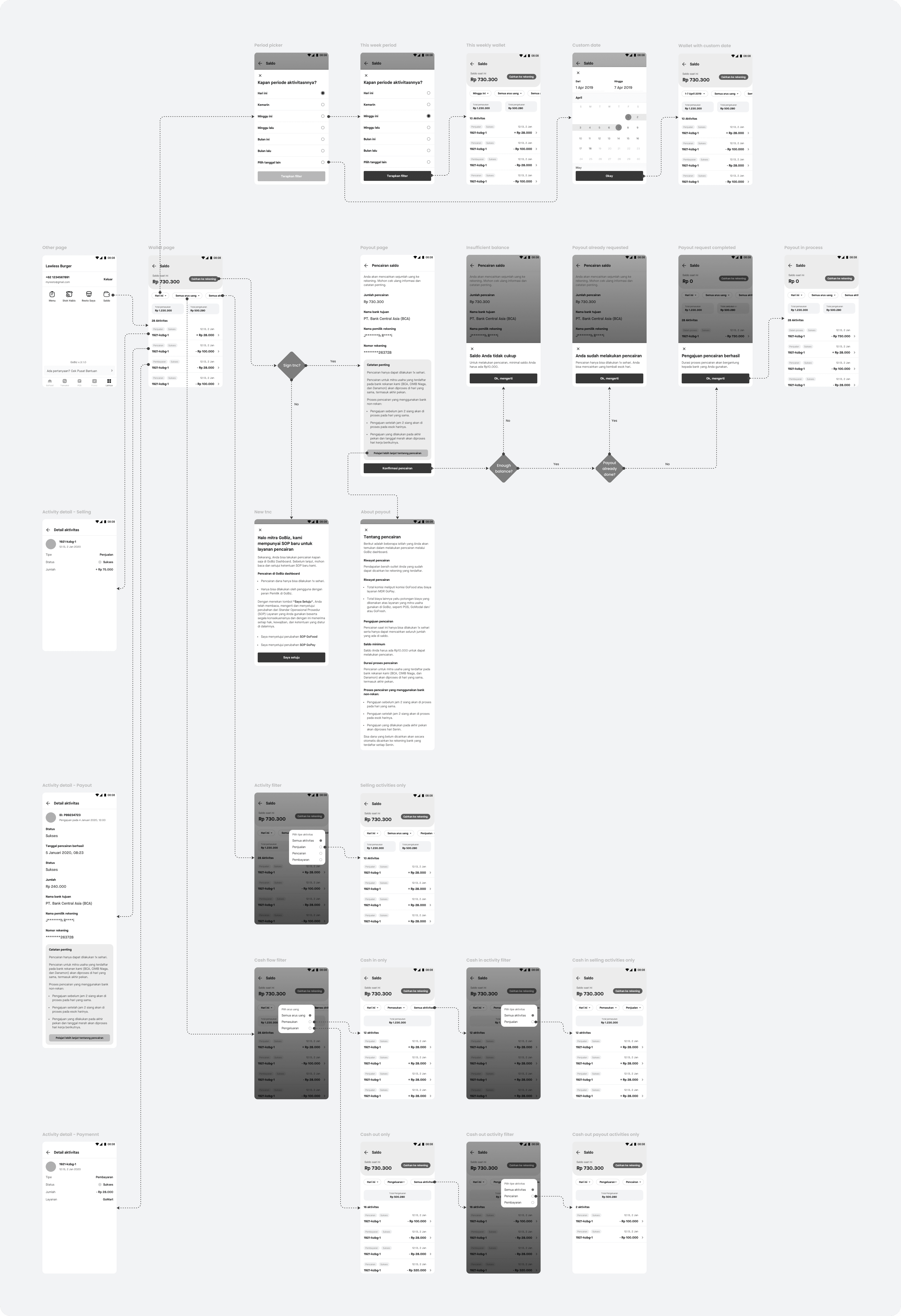

The new concept of wallet page

Since we retained the same technical structure for calculating payout-able earnings, users often misunderstood the UI, assuming the activity list directly reflects the wallet balance shown at the top.

As a result, many expected the wallet balance to dynamically update when applying filters (e.g., by date or transaction type), leading to confusion.

Wallet activity list, filter & details

Filter expectations: Users are more familiar with using date filters and expect the ability to filter activities by type for easier review.

Reconciliation behavior: Users prioritize transaction types like GoFood, GoPay, or POS over transaction IDs when reconciling records, contrary to the focus in the wireframe.

Visual clarity: Labels for activity types (e.g., payment, sales, payout) are too small, making it difficult for users to distinguish them at a glance.

Payout detail hierarchy: In the payout activity details, users found the important notes more useful than the static bank account info, suggesting a need to shift visual emphasis.

On-demand payout process

The current flow feels overly simplified, requiring just two steps, leading some users to overlook that a payout has been initiated, despite it being a critical action.

Users also perceived the Important Notes section as more valuable than the amount or bank details, since those rarely change and the notes provide essential context for the process.

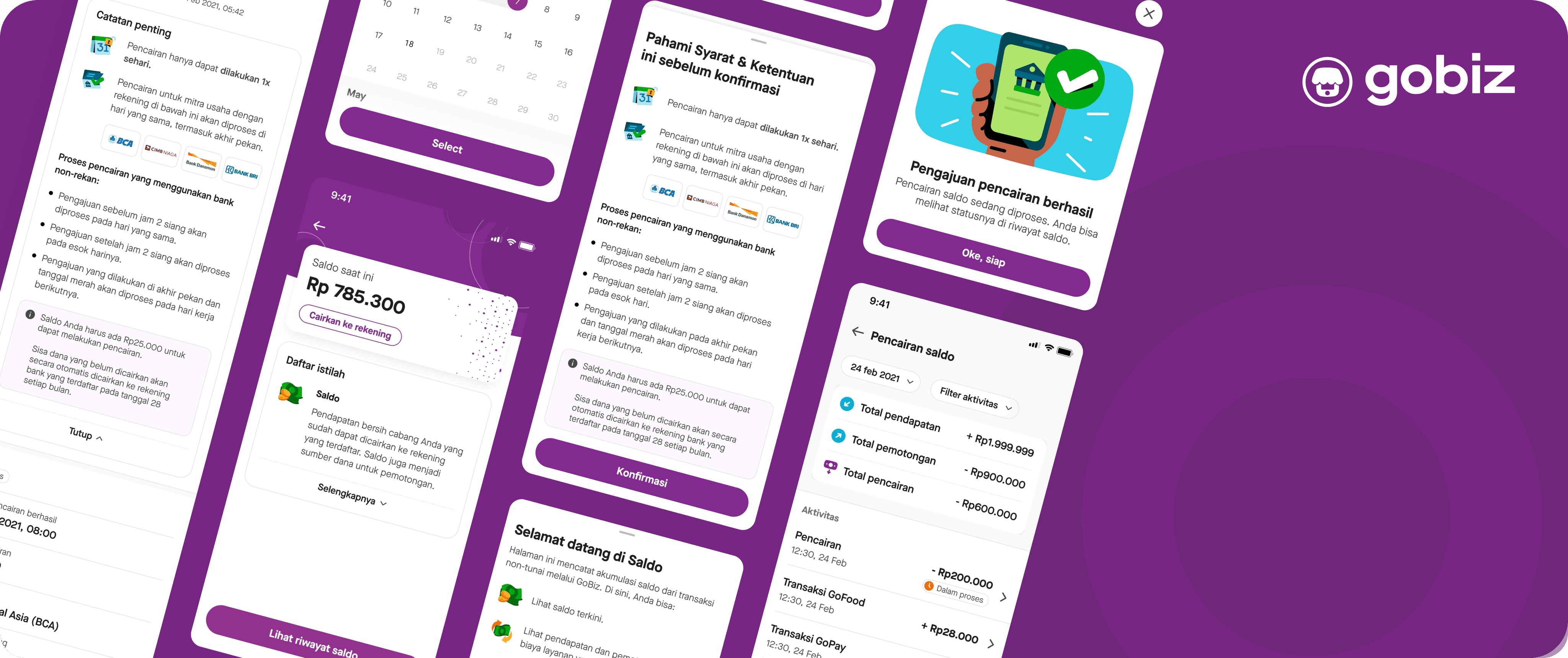

Final UI design

After multiple design iterations and continuous collaboration with stakeholders and cross-functional teams, I arrived at the final UI design for the improved payout feature. The result reflects real user needs, incorporates valuable feedback, and is aligned for implementation.

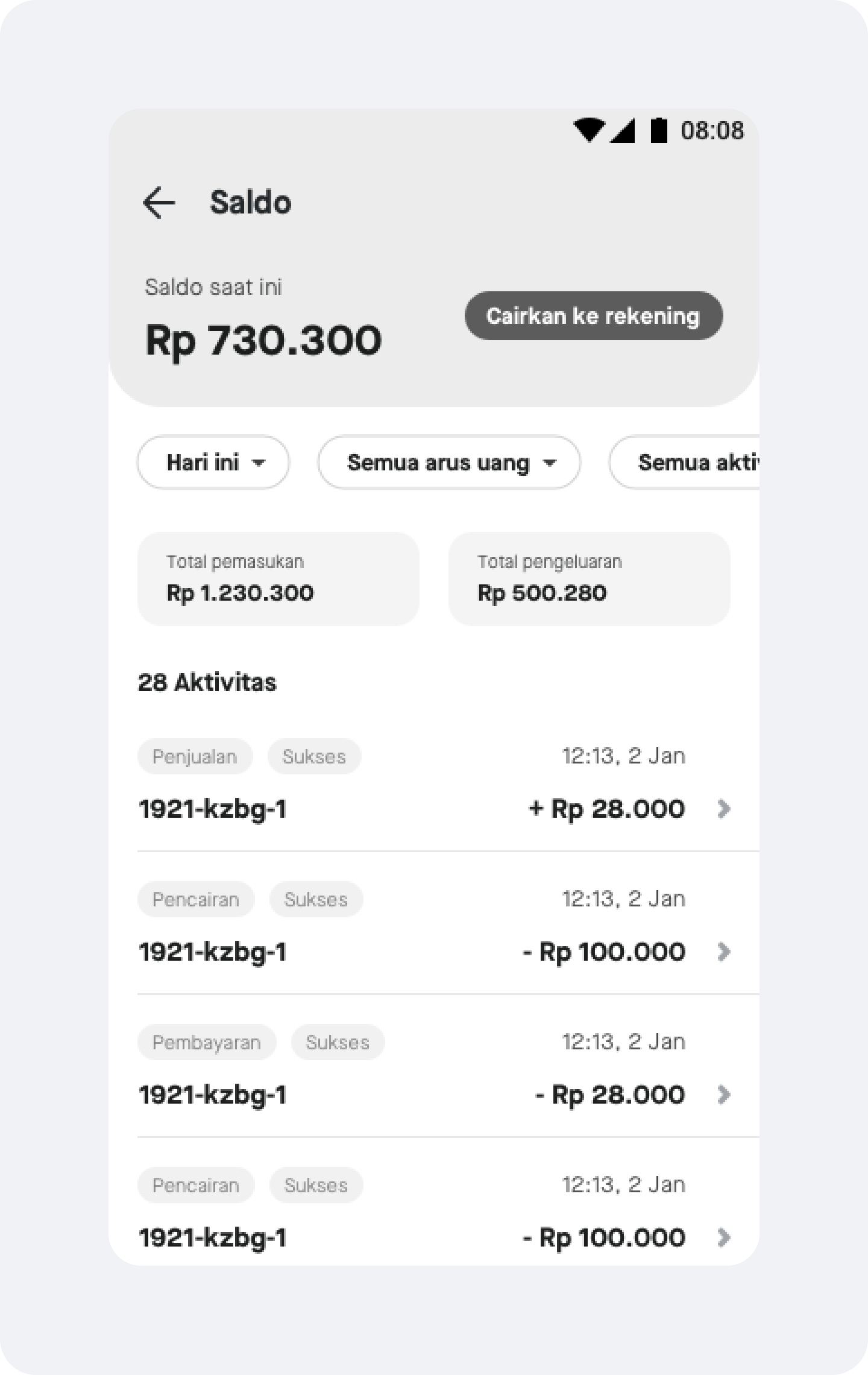

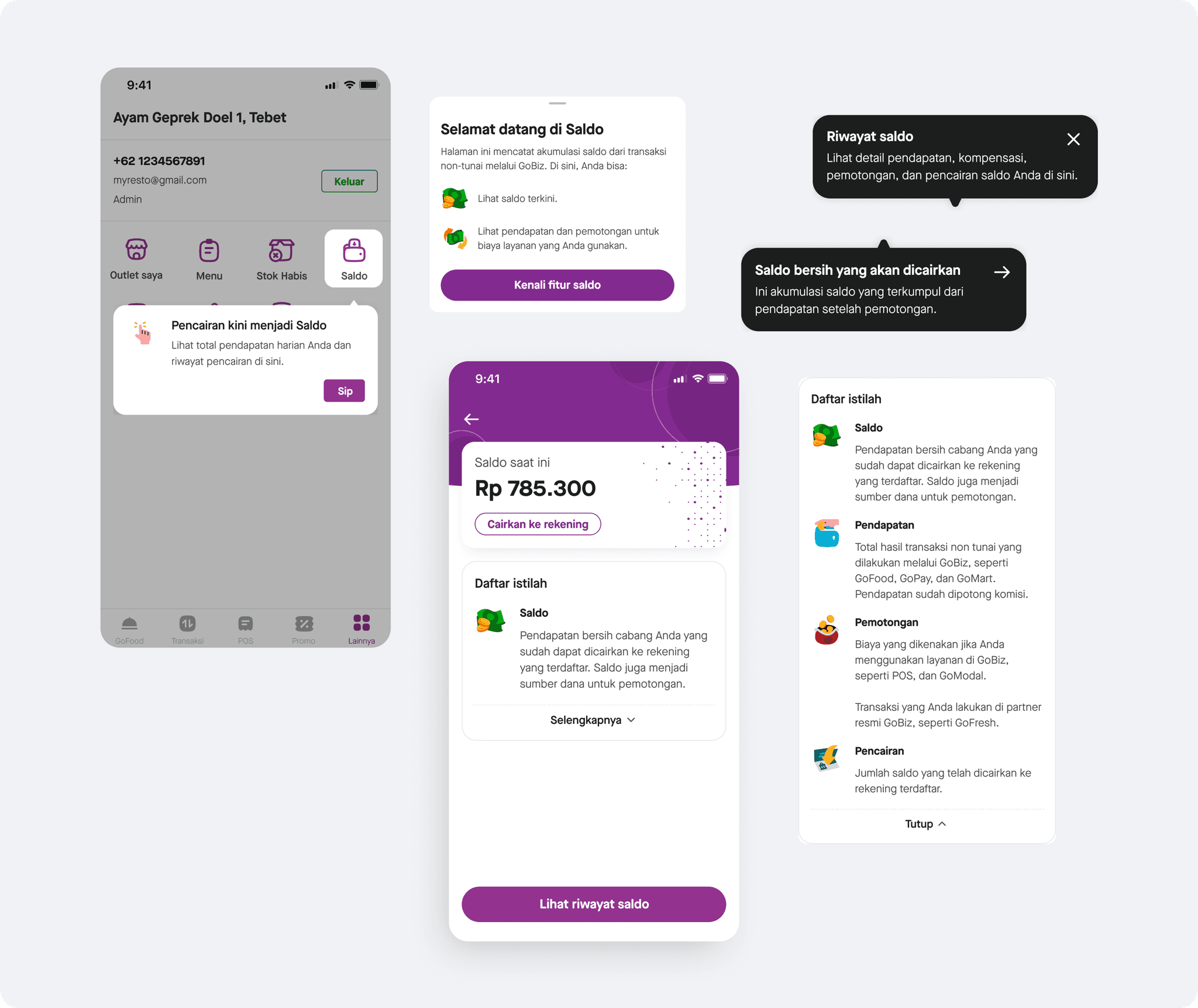

The new wallet feature

Based on usability testing insights, it became clear that merchants needed a clearer understanding of the new wallet concept. To address this, I separated the current balance and activity history into two distinct pages. This reduces cognitive load and prevents confusion between the two by helping merchants avoid associating them together.

The extra space also allows for clearer explanations of unfamiliar terms. To further support users, I introduced coach marks and one-time feature walkthroughs, ensuring merchants feel confident and informed when navigating the updated wallet feature.

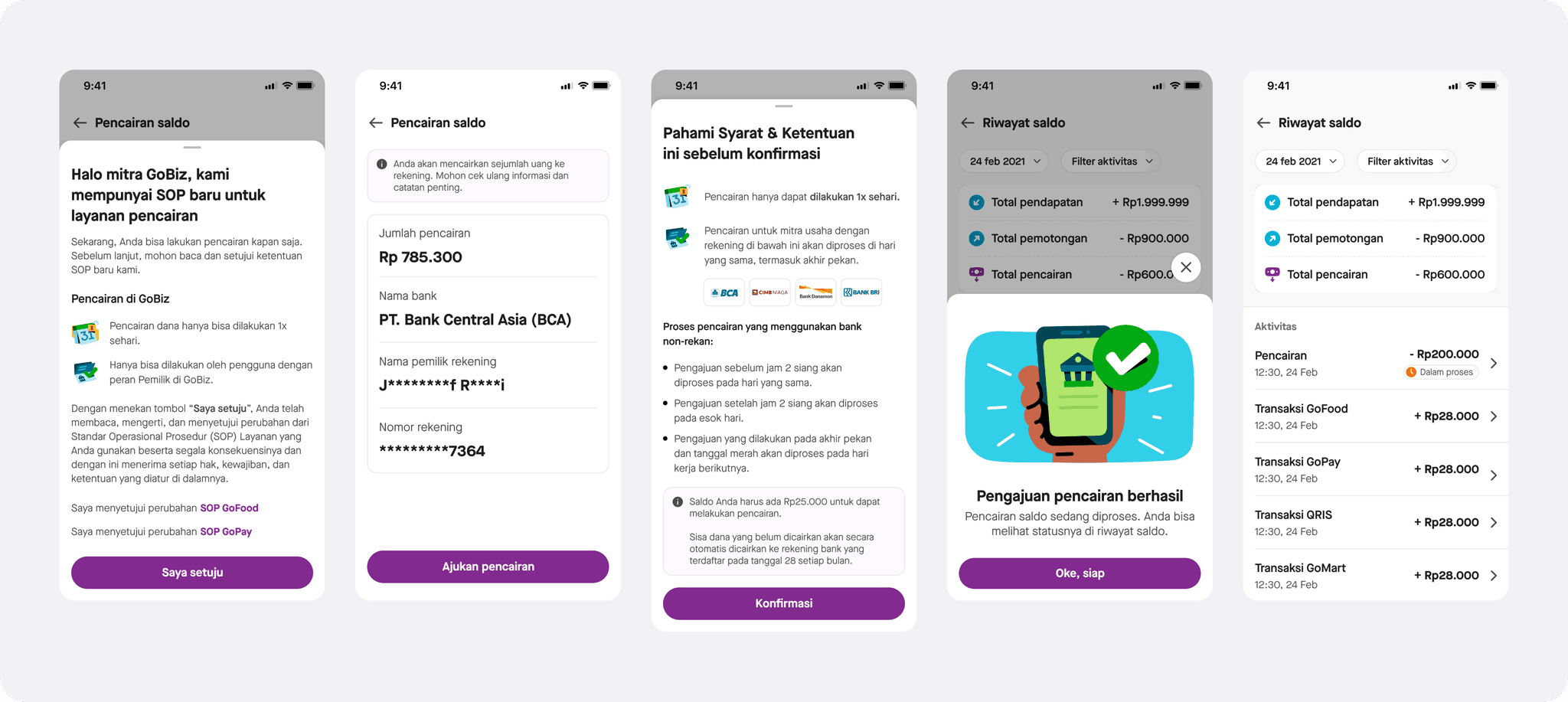

Requesting a payout from the wallet balance

In response to early user feedback that the payout flow felt too quick for such a significant action, I introduced an additional confirmation drawer. This extra step not only reinforces the importance of the action but also provides a clear reminder of the payout process and its conditions, helping users feel more confident and informed before proceeding.

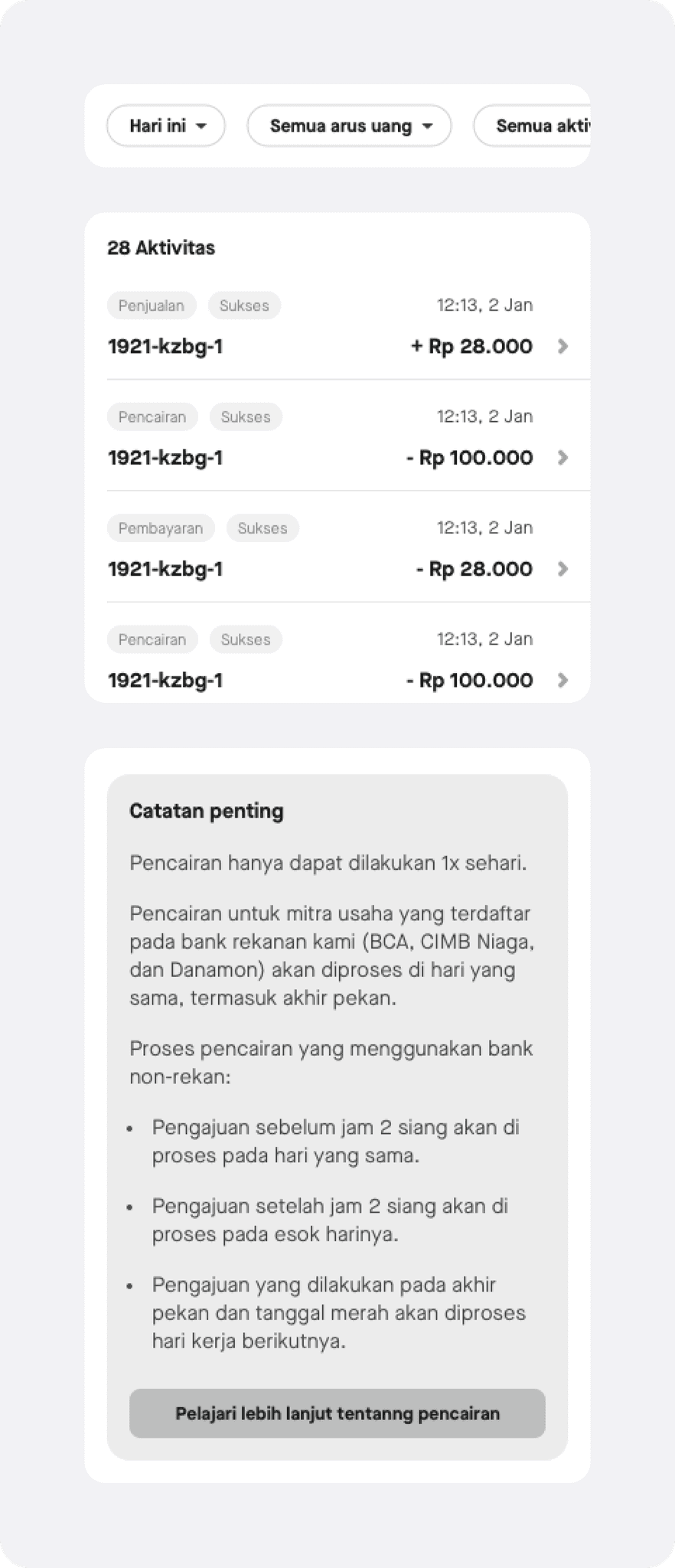

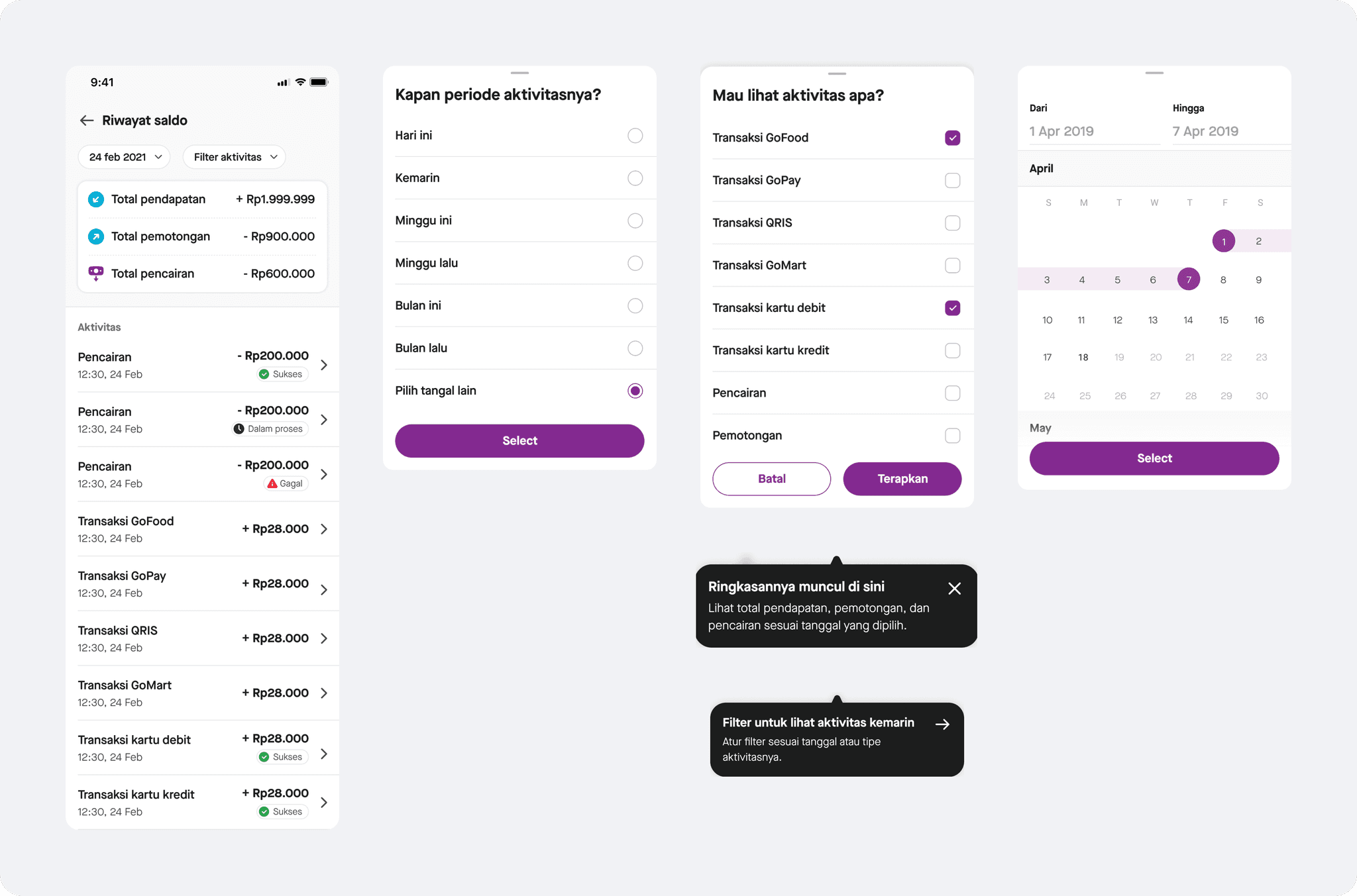

Wallet activity history

With the activity history now separated from the main page, I introduced summaries categorized by three key cash flow types: income, deduction, and payout. To better match merchant needs, the activity type is now the primary identifier in the list, while transaction IDs—previously emphasized—have been removed from the main view but remain accessible within the activity details for reference.

Additionally, the 'cash in' and 'cash out' filters have been removed, as they grouped activity types too broadly and often led to confusion. Instead, users can now select multiple specific activity types through a more detailed activity type filter, allowing for greater clarity and flexibility in viewing their transaction history.

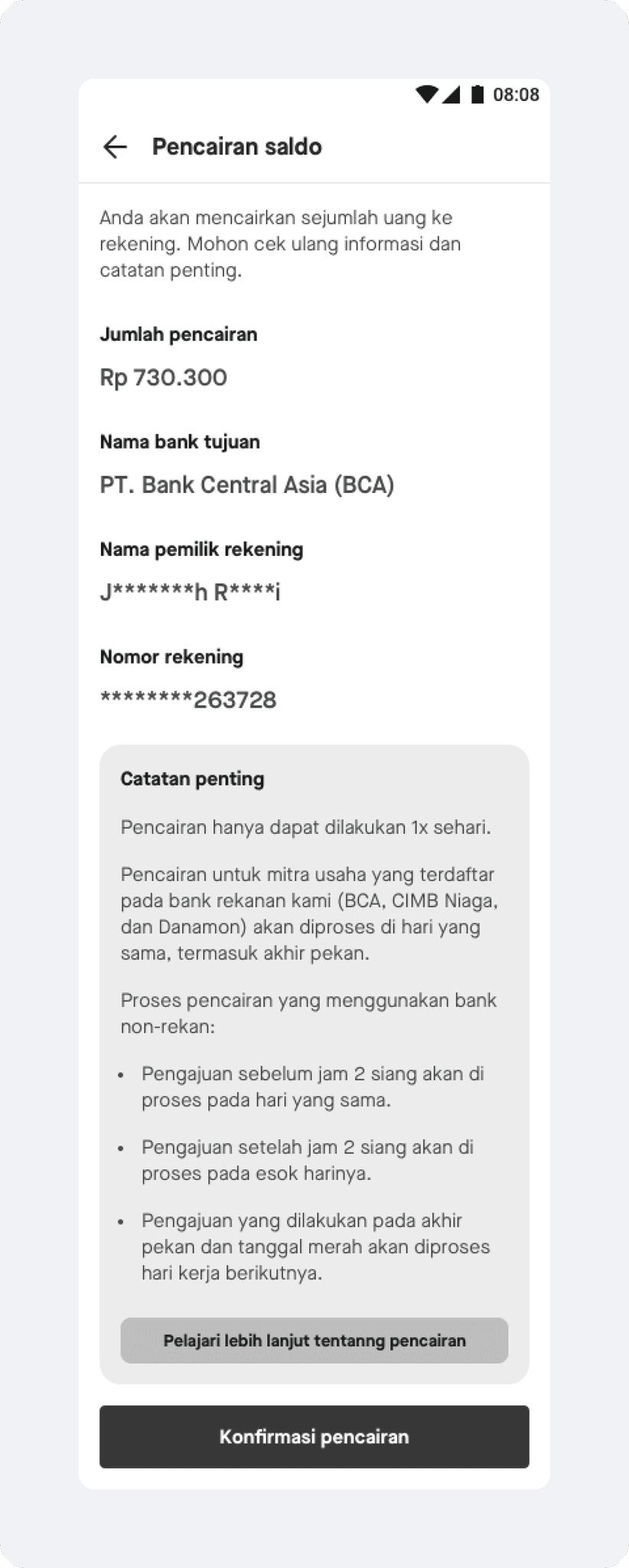

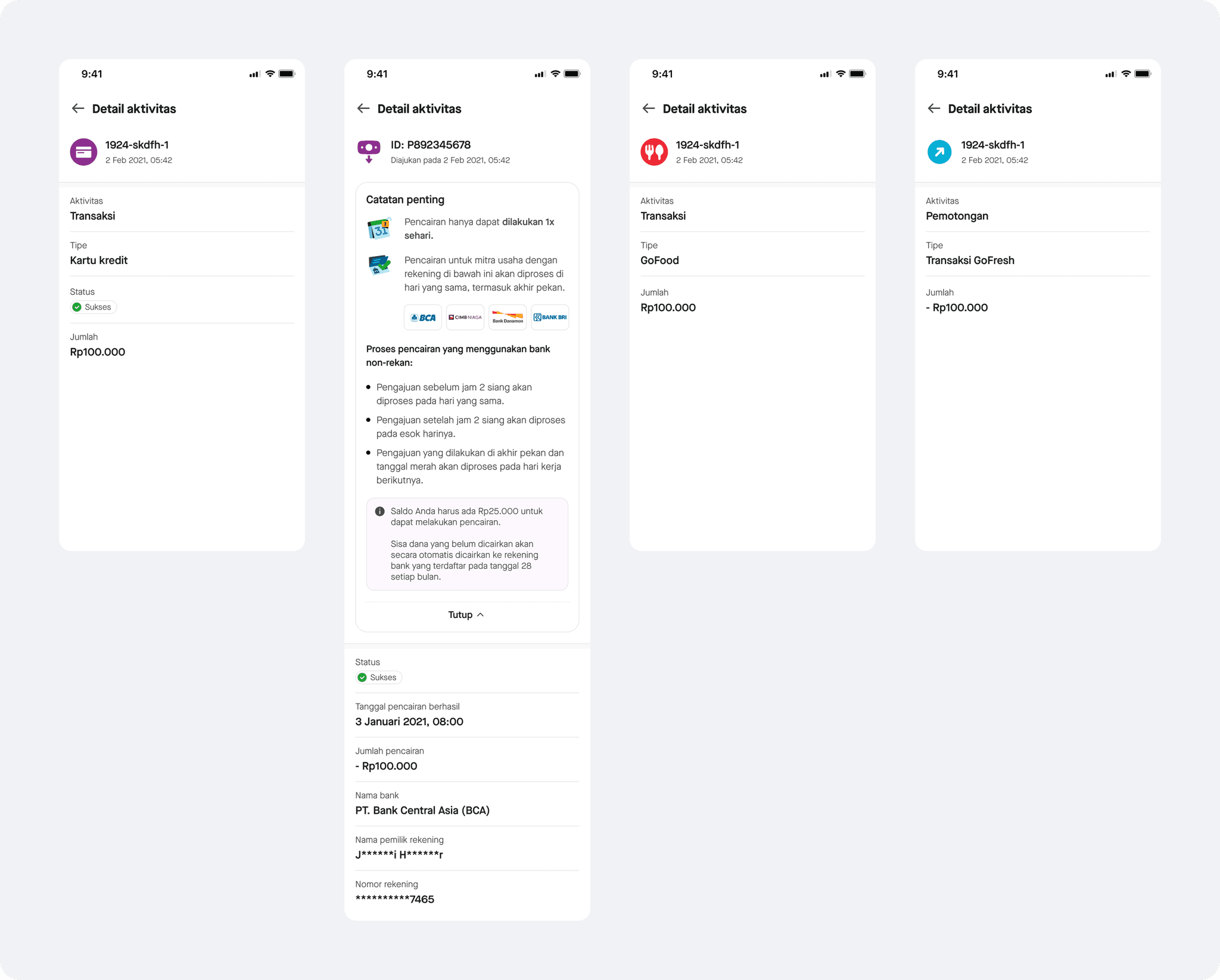

Viewing wallet activity details

To ensure clarity, the details page displays only the most relevant information tailored to each activity type. For payout-related activities, the “Important Notes” section is now placed at the top to emphasize key information about the payout mechanism. It remains collapsible, ensuring users can easily access the content below without missing important context.

Impact delivered

Three months after the feature launch, monthly complaint tickets related to payouts or wallets dropped by 75.67%, averaging just 342 tickets per month received by our merchant care unit. At the same time, payout frequency decreased to an average of 12 times per month, compared to daily occurrences previously, indicating improved clarity, trust, and user control over the payout process.